Interested in making a recoverable grant to the IVLP?

Contact Melissa Lockhart Fortner:

mlockhart@globalpartnerships.org

P: 206-456-7834

We see a gap in the early-stage impact investing market. Social enterprises are founded to tackle important problems and achieve positive impact. However, once they launch and the company begins the struggle to survive, the founders’ efforts to measure and manage that impact often take a backseat.

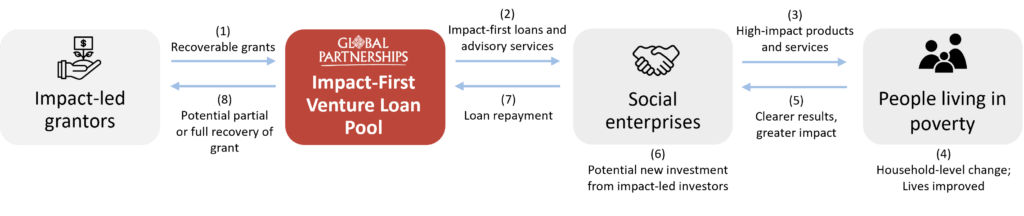

Global Partnerships’ Impact-First Venture Loan Pool (IVLP) aims to help address this gap. The IVLP provides early-stage social enterprises with a combination of non-dilutive loan capital and impact management advisory support. This approach allows us to not only finance early-stage social enterprises, but also help them create and refine the tools and systems they need to define, measure and manage their impact.

Structure

The IVLP is funded by recoverable grants made to Global Partnerships (GP). GP uses this pool of funds to make loans to early-stage social enterprises. Loans will typically be accompanied by strategic advisory services on impact measurement and management, including co-design, oversight, and funding of an impact study on client-level outcomes.

What We Look For

The IVLP targets social enterprises that:

- deliver products and services that expand opportunity for people living in poverty;

- principally operate in Sub-Saharan Africa, Latin America, or the Caribbean;

- use a business model capable of delivering inclusive impact at scale;

- have a significant customer base already receiving the product and/or service;

- have a Founder/CEO and equity investors that value clearly defined and demonstrated impact; and

- have a potential for significant growth and future need for financing to support that growth.

Our Portfolio

As of June 25, 2025:

Jackfruit Finance is a financial services provider offering tailored school improvement loans and capacity-building services to low-cost private schools in Kenya, enabling schools to invest in improvements that can contribute to increased access to education and/or improved learning outcomes for low-income students.

Diagnostikare is a digital health company offering quality, timely primary and mental healthcare and health information via a telehealth platform to low-income, under-served individuals in Mexico, enabling improved health and economic position.

Spouts International is a social enterprise offering affordable, effective ceramic water filters to low-income households in east Africa, enabling improved household health, productivity, and quality of life, as well as reduced carbon emissions.

Previous Investees

Fibrazo is a social enterprise that provides fast broadband internet access, via an affordable pay-as-you-go model, to urban and peri-urban households living in poverty, enabling cost savings, increased internet utilization, and potential improvements in quality of life, income, and/or education (depending on usage patterns).

Nilus is a social enterprise that enables improved food security for households living in poverty in urban and peri-urban “food deserts” through a tech-enabled community group purchasing model that sources groceries directly from suppliers and delivers them to target customers’ neighborhoods at an affordable price.