THE CHALLENGE

Many microentrepreneurs and small-scale producers cannot afford the up-front costs associated with productive asset purchases and do not meet the lending requirements of traditional banks, constraining their ability to grow their businesses.

THE OPPORTUNITY

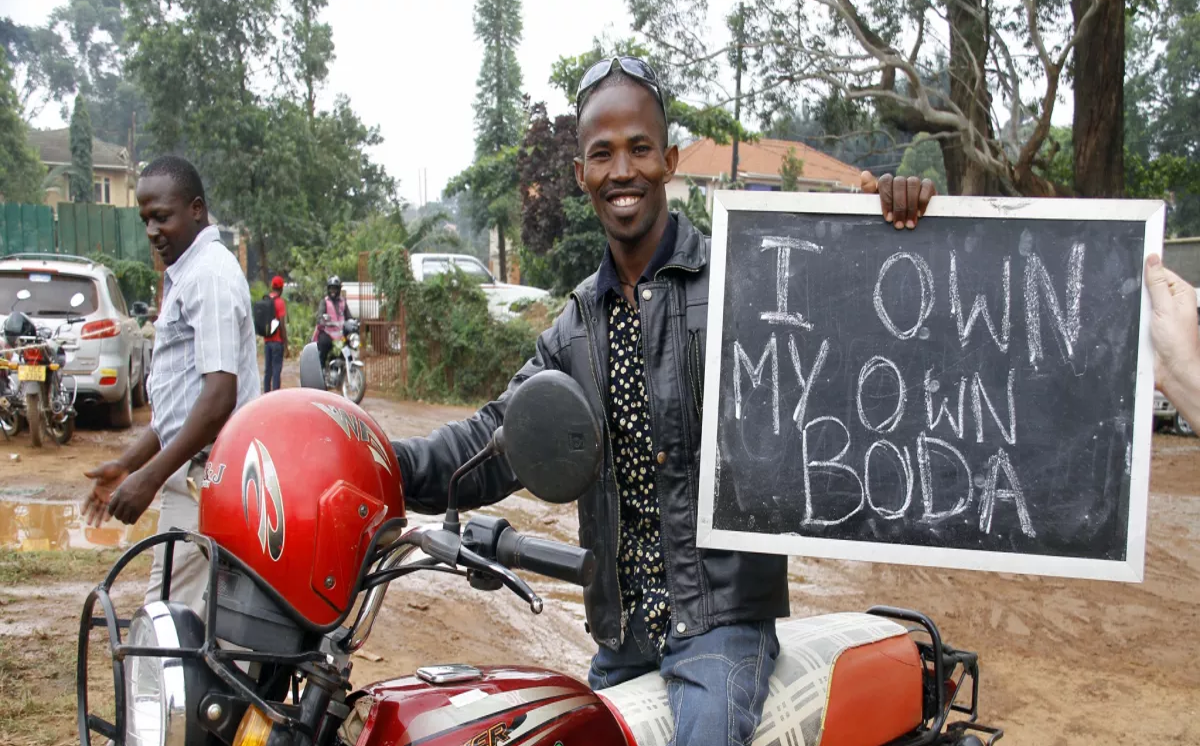

GP and its affiliated funds aim to increase the net incomes of households living in poverty by investing in social enterprises that provide microentrepreneurs with tailored loans for productive assets, along with support services to increase their likelihood of success, such as asset warranty, insurance, or training.

WHO IS SERVED

The target demographic is microentreprenuers and small-scale producers living on less than <$5.50 PPP/person/day.

WHAT IS DELIVERED

Clients must receive:

- Tailored, individual or group loans to finance a productive asset from a vetted supplier, underwritten for productive use

- AND basic know-your credit training

AND one or more of the following, as essential to the productivity of the asset:

- Product warranty and customer support;

- Insurance;

- Specialized training.

WHY IT IS IMPACTFUL

Household net incomes increase due to:

- Cost savings

- Revenue enhancement