CESMACH

Initiative: Smallholder Farmer Market Access

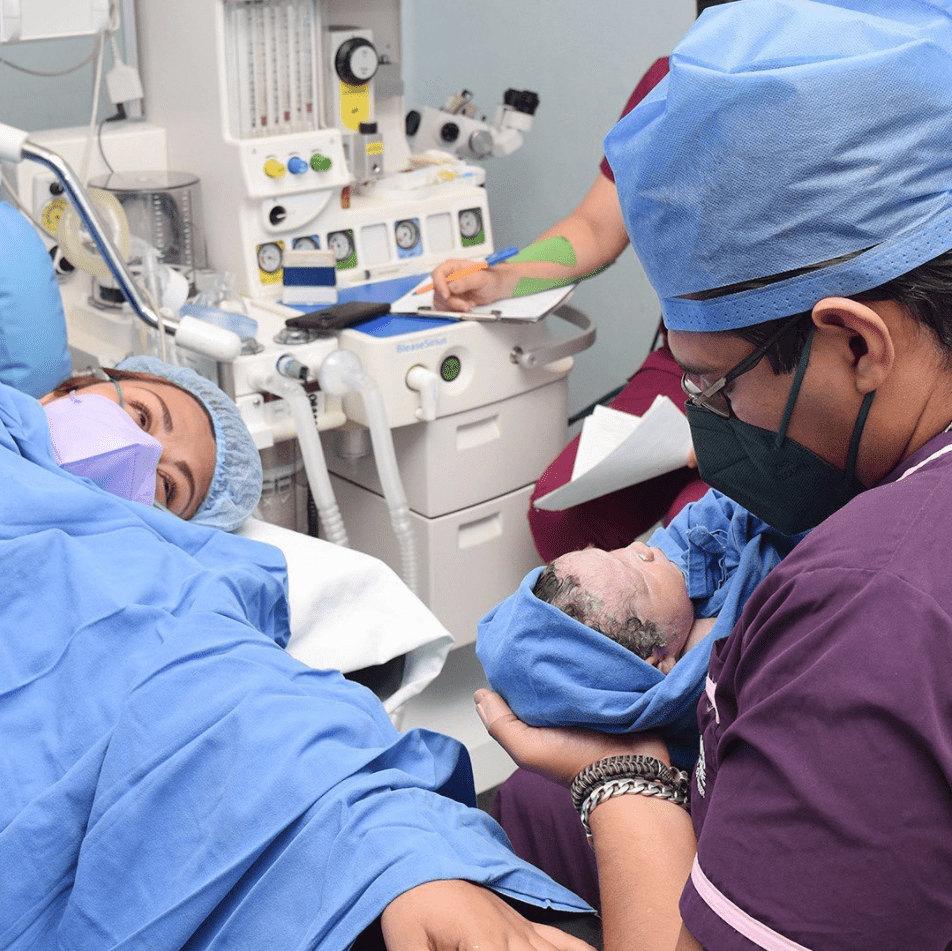

Diagnostikare

Initiative: Health Clinics

Reina Madre

Initiative: Health Clinics

SOFIPA

Initiative: Women-Centered Finance with Education

Ver de Verdad

Initiative: Health Clinics

VisionFund Mexico

Initiative: Women-Centered Finance with Education